Buy Cash-Only or Cash & Mortgage is one of the First Tutorials in the “Buy To Let Seesaw Series” as the decision is one of the first that every Buy To Let Investor has to make, even before starting to search for their first Property as, having had an offer accepted, credibility is lost if you cannot immediately move towards Exchange of Contract but have to make an offer subject to having a DIP, a Mortgage Decision in Principle.

Tips on reading this Document – Throughout these Tutorials, all the Main Points are in a Normal 10-point typeface.

When looking at any content that includes figures, I take you through content and figures bulleted step-by-step which I find easier to read trying to only have one figure per bullet.

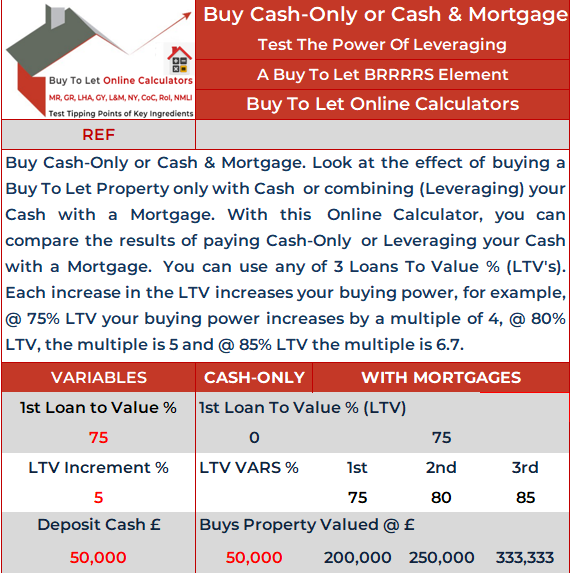

To Continue – Play with the Buy Cash-Only or Cash & Mortgage Calculator below. Find your right variables for buying with a combination of Cash & Mortgage and you will see that the Cash & Mortgage options are more profitable than Cash-Only, both in respect of Rent and Gain because you have increased the Capital Value of the Asset, the Property.

As a rule of thumb, you should aim to always Exchange Contracts within 7-Days having carried out all the normal Due Diligence.

If the Vendor delays or is tardy, pressure them to keep to a 7-Day timetable..

Until Exchange of Contracts has taken place either Party can withdraw without penalty and most Buyers will have incurred costs that are not reimbursed or recoverable.

This is one of the reasons why I don’t Survey Properties before Exchange but operate a Buying Without A Survey Policy that makes Surveys unnecessary.

1 in 3 Property purchases fall through with one or both sides withdrawing either due to gazumping, or problems arising that were not apparent at the time of Offer so always consider Home Buyers Insurance

At Auction, Exchange Of Contracts takes place on the Fall of the Hammer with Completion between 14 & 42 Days later. Withdrawal by either party involves financial penalties.

The reason for the Seesaw Analogy is that, as with many aspects of Buy To Let, often two or more ideal Strategies are not compatible, resulting in a Buy To Let Investor having to decide which one of the “ideal” Strategies to opt for as you cannot have a bit of one and a bit of another, unless of course you buy more than one Property at the same time or in the same period, when each Property can sit at the top of an individual Seesaw.

The Seesaw Analogy crops up throughout a Buy To Let Strategy Decision Making Process with most Seesaws involving incompatible options for best results.

Option Examples:

Are you going to invest in Freehold or Leasehold Property, and here there is no halfway house. Most Houses, from Terraced through Detached, are Freehold whilst Flats & Apartments are mostly Leasehold.

Are you going to house Families or Sharers? Though Families can live in Sharer Housing and vice versa, highest returns result from a Property that undergoes a Fit-for-Purpose Renovation particularly in respect of the layout and location.

Families want Family Rooms, Kitchen & Sitting, whereas Sharers, whether Students or Working Professionals, want private Sleeping Rooms along with communal Kitchen/Dining Rooms.

Now to look at the Buy Cash-Only or Cash & Mortgage Online Calculator, one such Seesaw.

Buy Cash-Only and your Buy To Let (BTL) is safe provided you have the Property fully insured, which I cover in Insuring A Buy To Let, because most if not all the liabilities that can arise from owning a BTL Property can be insured, except for Voids, unlet periods.

The main exception is repairs arising out of general wear and tear, but you can reduce the cost and number of repairs that will arise by increasing the quality of your renovation, futureproofing the specification, and using commercial materials.

When specifying your Renovation lean towards Commercial rather than Domestic as rented Property always suffer a much higher amount of wear and tear than a private home, however careful the Tenants.

On every change of tenancy think “Restore To As New” as the costs will be lower than extensively repairing and new Tenants will take more care. Sorry

A Buy To Let Property is a safer Investment than most other Assets, such as Stocks and Shares, because a Property cannot go bankrupt.

You can personally go bankrupt through bad management, bad decision-making, bad market conditions but the Property will still physically exist or at least the land on which it sits, unlike a Company, like Lehman Bros and General Motors, which have completely disappeared.

Buy with a Mortgage and you introduce Risk, the other end of the Seesaw.

Fail to keep up the payments on the Mortgage, and you risk the repossession of your Property by the Mortgage Company and, if you are lucky, a sale after repossession at a price that repays the Mortgage.

Or unlucky, if the sale does not repay the Mortgage, then you will not only lose any Cash that you invested in the Property but still owe money to the Mortgage Lender putting all your other Assets at risk including your home if you own it.

Now obviously, if your Mortgage is quite small, then the scenario where you lose all your Cash will also be quite small.

The minimum Mortgage is £ 25,001, below that sum any borrowing is a Personal Loan and subject to different Laws & Regulations.

Also, if the Mortgage is quite small and you do not receive any Rent for months, then you may be able to service the Mortgage out of other income making the possibility of repossession even smaller.

For this reason, I recommend starting by developing an Initial Portfolio of 3 Properties, one to Rent, one for Gain with positive Cash Flow and the third, either Rent or Gain.

This Strategy should provide adequate Risk Protection.

If this Strategy is adopted, it will affect your choice of both Location, Neighborhood and Type of Property given that you are starting with a finite amount of cash from all Cash Sources to cover Transaction Costs, Deposits and Fix- Up Costs.

Regardless of how good the condition is of the Property you buy, even New Build or Rented, always assume that you will have Fix up Costs.

There are also a substantial number of Mortgage Lenders, including Specialists who only offer Buy To Let Mortgages such as Paragon, and others, mostly Banks, offering BTL Mortgages amongst a Portfolio of Mortgages.

But the more that you borrow the greater the return on your Cash, and the greater the profit.

Provided of course that you bought and let wisely, which I cover in detail in Set 6 Property Opportunities.

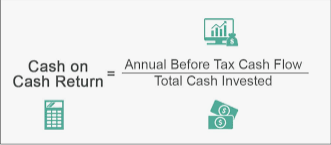

Now, throughout all these Tutorials. I will always be talking about a Cash-On-Cash Return or COCR, because you need/must be able to compare investing in Buy To Let with investing in any other type of investment or Asset Class.

I use COCR rather than ROI, Return on Investment, because the term/word Investment is ambiguous and can mean the whole Investment or the Cash invested.

COCR has only one meaning, Cash Invested.

Using small numbers for example purposes,

There are two Profit Centres in Buy To Let, Capital Gain or Increase in Value and Rent or Yield.

A Capital Gain occurs either from a Market-Driven increase in values or Forced Appreciation, where the Property is both extensively renovated and modernized by an Investor.

Historically Property Values have increased in line with incomes, which in turn have tracked inflation, so you can assume that over any period of years, Property Values will inevitably increase regardless of whether an investor renovates the Property or not.

Capital Gains apply to most types of investment, the difference is that there is little an Investor can do to increase the value of a Share or Fine Wine, but an Investor can renovate a Property, restore a Classic Car, or Antique and increase the value.

Rent or Yield equates to the Stocks and Shares Dividend and are not dependent on the sale of the Property in Buy To Let.

To release a Capital Gain, the Property must either be sold, or used as security for a Loan.

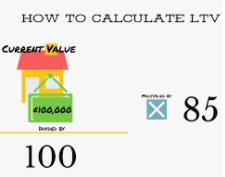

Commonly, up to 85% of the value of a Buy To Let Property, the Asset, could be raised by way of a loan in which case, CGT, Capital Gains Tax, would not be payable as loan monies, spending money, is not taxable in the UK.

When comparing Property investment with other Asset Classes. It is only Property, Stocks & Shares that naturally produce a regular income. The other Asset Classes that I have mentioned such as Antiques and Fine Wines do not naturally generate an income.

,

So, let us look at Capital Gai, and it will help you if you open the Buy Cash-Only or Cash & Mortgage Calculator at the same time. The low figures I am going to use are still for illustration purposes.

If you buy a Property, which cost £25,000, and it is possible even today, Jan 2024, to buy a distressed Property for £25,000 in many Locations across the UK.

As I have said, the Returns increase the more that you borrow because the Asset Value is increased, but the more that you borrow, the higher the risk of the investment going pear-shaped.

If you buy a Property costing £50,000, and there are plenty of opportunities particularly distressed Property at Auction for BRRRRS Strategies.

£2,500 is 10% of your £25,000 Cash Investment or double the COCR of 5% of your Cash-Only Buy.

Increase the risk by borrowing even more of the cost of the Property and your COCR also increases.

Press the pedal a little harder.

As you lower the LTV, you increase the margin of Lender’s safety, which results in lower Interest rates and better Lender terms.

Now let us turn our attention to the Rent or Yield, the equivalent of the Dividend in Stocks & Shares, applying the same variables.

There are 3 Rent or Yield Variable and how they interact determines whether you have positive or negative cashflow

They are the LTV which sets the Mortgage Amount, the Yield and Interest Rate. See the Yield Interest Rate Interaction Calculator

Taking the same starting position of

Unlike Stocks & Shares, and most other Asset Classes, with Property you have operating costs which mostly occur annually such as:

All these costs are covered individually in later Tutorials but, for the purposes of this Tutorial, we will assume that:

So, with this example, your £25,000 Cash produces:

To continue with the Rent or Yield

Only Letting & Management is generally a percent of the Rent, Insurance Premiums are Property Value related and Repairs are an Hourly or Works Cost

The COCR on the Rent or Yield does not increase as dramatically as is the case with Capital Gain.

Adopt a high-risk 85% LTV Strategy and with high-risk comes a high return but Yield, COCR, increases to 8.83%.

Now, as I have said, I have set the Operating Costs at 20% of the Rent, but in reality, except for the Letting and Management Charges, Operating Costs are not linked to the Rent but to the Property therefore as you increase the LTV the actual Cash-on-Cash Returns would be slightly higher.

You could apportion 10% of the Rent to Letting and Management charges and apply a Fixed Sum of say £500 to the other Operating Costs.

This would have the effect of reducing the COCR on the Cash Purchase and increasing COCR on the higher levels of LTV.

It is the ability to borrow that makes Buy To Let a unique Investment and it is the ability to borrow that increases your profit, provided you have made a wise decision in respect of both the Property, Location and Neighborhood, plus the variables that affect the calculations in this Tutorial.

So, the bottom line is, whether you are investing for Gain or Rent always borrow pr.

This brings me to the end of this Tutorial. I hope that you have found it interesting and worthwhile and that it helps you to understand one of the basic concepts of Buy To Let as the decision to Buy Cash-Only or Cash & Mortgage is one of the prime ingredient in the Buy To Let Fruitcake.

As I said, there is an Ingredient Calculator which allows you look at how the variables impact on both Property Gain and Rent/Yield, whether bought with Cash or a varying Mortgage LTV’s.

This is David Humphreys signing off and I look forward to seeing you on the next Tutorial in this Set, Investing for Gain or Rent/Yield and the relationship between Cash-Flow and Value-Increases